Working abroad can be a little frustrating especially when you’re filling up the necessary paperwork for taxing purposes and other administrations. Ex-pats in Indonesia can sometimes get confused as to what preparations should be made when you’re starting to work here, especially when it goes to the taxing and payroll system. In Indonesia, work is considered legal and up to taxing when a person has a tax number or in Indonesia, it’s called NPWP (Nomor Pokok Wajib Pajak). Luckily for you, here we’ve listed some useful ways to obtain NPWP for ex-pats when they’re started to work in Indonesia. Check this out!

Want to know how to get a work permit in Indonesia? Click here!

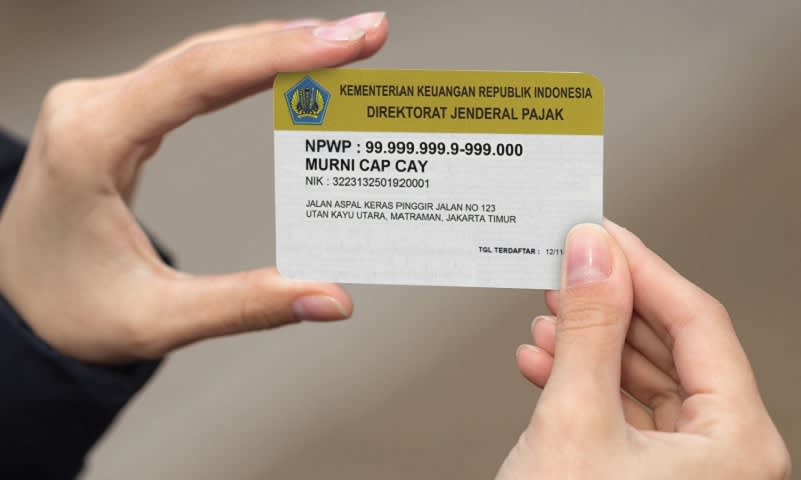

Further Explanations about NPWP

TaxWhen you start working in Indonesia, every company will be asking for your NPWP before you’re hired to prevent legal measures. All residents including ex-pats must have their tax numbers. However, it does exclude some groups like child laborers who are too young for work.

The tax office (Direktorat Jenderal Pajak) requires all ex-pats in Indonesia to register with the tax office and obtain their separate tax number (NPWP) and pay monthly income taxes, file annual tax returns, and pay tax on their income earned outside Indonesia, less tax paid in other jurisdictions on the additional overseas income.

The government defines an individual taxpayer, who is required to register for NPWP and file income tax returns, as:

- Employed individuals who earn income above the non-taxable income,

- Employed individuals who receive income outside of their main salary,

- Individual taxpayers who receive income from trade/business activities, self-employment or exercise of the profession;

- Individual taxpayers who receive income from capital; and

- Foreigners who reside or present in Indonesia for more than 183 days within a single period of 12 months or who are present in Indonesia and have the intention to live in Indonesia. These 12 months is based on 12 months before the present day. The “intention” to live in Indonesia is seen by such actions as applying for a work permit, owning or renting a house for an extended period, and bringing family members to Indonesia. Please be advised that, according to the law, those who must pay Indonesian income taxes if they’ve been here the 183 days in a calendar year, include, those ex-pats here on ITAS, ITAP, business visa or social/visit visas!

- If you stay less than 183 days a year in Indonesia, then you may not be obligated to pay Indonesian income tax (only taxes from your home country). You must prove it by showing your visa stamp and fill out FORM 1770 Individual and Monthly SSP (Tax Payment Slip/Surat Setoran Pajak). Of course, you must have an income tax number first to complete this form.

- Dependent spouses are included in the husband’s tax number and do not have to have a separate number.

Place to Register

All employed individuals in Indonesia including ex-pats must register at the Tax Service Office in your city of residence. Ex-pats living in Jakarta are required to register with the Tax Office for Foreign Bodies and Expatriates (KPP BADORA) which is located in Kalibata, South Jakarta.

The registration, monthly tax payment, and annual return can be prepared and submitted by an appointed representative, usually an accountant specializing in tax matters. Be sure that you receive a good referral, as to remember that you are legally accountable for any non-payment of taxes.

Before registering, you need to prepare some files which are:

- a completed registration form

- photocopies of all the pages in your passport

- photocopy of your work permit

- certificate of the domicile for you and your employer

- photocopy of your employer’s tax number(NPWP)

- Letter of Authorization, authorizing your representative to register and handle your tax matters.

- While the registration form only asks for a copy of the ID page of passport and does not request the other items mentioned above, the bureaucrats at the Tax Office ask for them as a matter of course.

Once you have registered, taxes are due and payable not later than the beginning of the 15th day of the following month, and reports should be submitted to the tax office by not later than the 20th day of the same month.

Want to know where are the best places or agents to get a work permit in Indonesia? Click here!

Register NPWP Online

Now you can also register your NPWP online so you don’t have to leave your house and go to the Tax Office for Foreign Bodies and Expatriates (KPP BADORA). You can register for an NPWP Online through the website. This online process, all files and documents that need to be prepared remain the same as the offline process.

1. Create an Account at Ereg Tax

You must first create an account by accessing the website created by the Directorate General of Taxes to serve online NPWP registration, namely the tax Ereg website (https://ereg.pajak.go.id).

2. Complete the Documents according to the requirements

As a taxpayer, you must prepare several required documents as stated in the previous explanation.

3. Sending Electronic Files

After filling out the form on the website, click the “Token” (secret code) button on the dashboard. Don’t forget to check your email. Then copy-paste the token in the email and go back to the dashboard menu. Then, click “Submit” and paste the token code in the “Token” column. After that click “Send Request”.

Once approved, your NPWP card will send it to the registered residential address. If after that period, you haven’t got it either, chances are there are documents that haven’t been completed or are interacting illegally. You can re-register your NPWP online by following the cycle procedure above or call the KPP where you are registered for more information.

The Importance of NPWP

Obtaining NPWP for both locals and ex-pats is very important that it has some interlinkage to other activities. Some activities require NPWP as an incentive so that everyone must obtain before doing these kinds of activities. The Indonesian tax office continues its drive to widen the taxpayer base by trying to register all salaried Indonesian nationals for their NPWP number. Some activities that require NPWP are:

- buying a motorbike

- getting a driver’s license

- building a house

- opening a bank account

- renewing registration of a vehicle over a certain value

- issuing a credit card

- having a credit card limit above a certain amount

- payment of housing tax on houses over a certain value

- applying for a passport (for Indonesians)

- when you transfer money from your Indonesian bank account to a foreign bank account

- starting a telephone subscription

- starting a business or direct investments

- buying a land (to finish the transaction)

- importing a certain product

In the end, obtaining an NPWP is a very important matter and there are ways to obtain it. So, if you’re currently an ex-pat or foreign workers who have zero ideas regarding this matter, this article can surely help you guide through. You can then work peacefully without ever frustratingly think about this matter anymore!

Find out more of our other guides and recommendations on our blog!